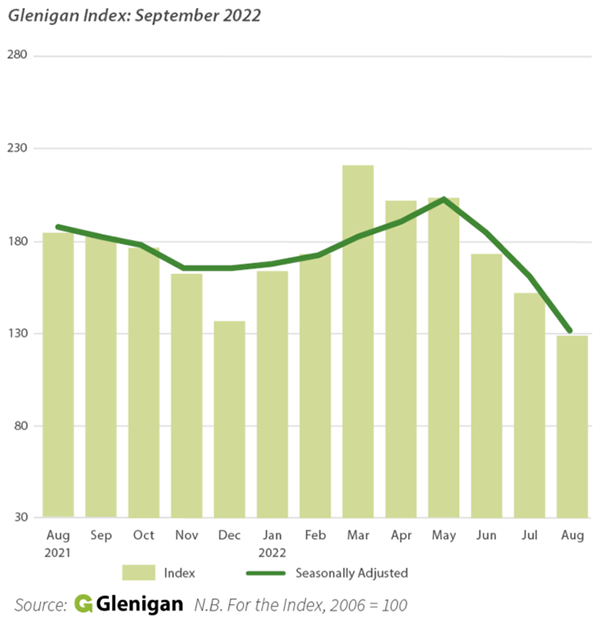

Project-starts fall sharply as recession nears

– Underlying work commencing on-site falls 35% against the preceding three months to August, 30% lower than a year ago.

– Residential project-starts plummet 38% on the preceding three-month period and 28% against the previous year.

– Non-residential project-starts down 31% against the preceding three months and 34% compared with a year ago.

Economic Uncertainty

Construction has experienced considerable disruption in recent months, and industry recovery continues to be held back by a variety of external factors including: ongoing supply chain issues and rising energy costs as materials inflation continues to accelerate due to the Russia-Ukraine War, creating considerable economic uncertainty.

As observed in previous Glenigan Indexes, delayed project-starts continue to squeeze the sector and a recent drop-off in contract awards and planning approvals has derailed Q.1 and Q.2 2022’s strong developmental pipeline.

It paints a gloomy short term picture for the UK construction industry. However, with Glenigan’s Summer Forecast predicting an uplift in activity by the latter half of 2023, it’s hoped these setbacks will be short term.

Sector Analysis – Residential

Residential project-starts weakened significantly during the three months to August, with the value falling 38% against the preceding three months to stand 28% lower than a year ago.

Similar to the August Index, social housing project-start performance was especially poor, declining 38% against the preceding three months and standing 40% down on the same time last year.

Private housing-starts also faltered, declining 38% against the previous three months and dropping 24% compared with a year ago.

Sector Analysis – Non-Residential

Overall, non-residential project-starts experienced across-the-board decline, falling 31% against the preceding three-month period and 34% compared with the year before.

Civil engineering-starts posted the largest fall of any non-residential sector vertical, dropping 27% against the preceding three months and 25% compared to a year ago.

Focusing on civil’s sub-verticals, infrastructure and utilities project-starts also tumbled, falling a quarter and a third respectively during the three months to August, and both by a quarter against the previous year.

Despite strong performance in the first half 2022, industrial project-starts declined 25% against the preceding three months as well as 27% compared to a year ago. Commercial offices also continued on its recent downward spiral following a spurt of post-Pandemic activity, experiencing the steepest fall of any sector. Project-starts declined by more than half (-51%) against the preceding three months to stand 48% down on the previous year.

Health and education construction-starts weakened too, with starts on site falling by a third and 18% against the three months to August, respectively. Both verticals experienced a value decline against the previous year, with health project-starts falling back by a fifth and education project-starts dropping down 36%.

Hotel and leisure remained largely unchanged, with starts dipping a modest 2% compared with the preceding three-month period. However, the decline was more noticeable when measured against the same time in 2021 (-38%). Vice-versa, community and amenity project-starts fell down 51% against the preceding three months, but only declined 5% compared with the year before.

Regional Outlook

UK regional performance was extremely poor, reflecting the sector’s overall decline.

Northern Ireland was the highest performing region, and the only region to experience growth against the previous year, with a value increase of 87%. All other UK regions registered a decline compared with the year before.

Wales experienced a relatively good period compared to other regions, with project-starts seeing a modest decline of 6% against the preceding three months and 8% compared with the previous year.

London posted the weakest period for project-starts, with the value declining 55% compared with the preceding three months to stand 62% lower than a year ago.

The East Midlands and Scotland both endured steep falls during the three months to August to stand 37% and 35% lower than the same time last year.

Commenting on the findings in the August Index, Glenigan’s Economics Director Allan Wilen says, “The sharp drop in project-starts is a disappointing yet unsurprising turn of events. Recovery continues to be hampered by materials, energy and fuel inflation caused by the Russia-Ukraine war, and now inflation spikes, higher taxes and more stringent building regulations are catching up with construction firms and constraining activity.

“The uncertain economic outlook has prompted construction firms to reappraise and revise projects, resulting in a shrinking development pipeline. It’s now having a knock on effect on project-starts. This lull in activity is likely to continue in the near future, but I am confident that there is light at the end of the tunnel.”

Glenigan Indices (underlying* projects up to £100 million)

|

|

Glenigan Index |

Residential |

Non-residential |

Civil engineering |

||||

|

|

Index |

% Change |

Index |

% Change |

Index |

% Change |

Index |

% Change |

|

Aug-21 |

184.7 |

41% |

261 |

44% |

143 |

44% |

133 |

18% |

|

Sep-21 |

182.7 |

30% |

255 |

26% |

143 |

44% |

132 |

1% |

|

Oct-21 |

176.5 |

10% |

246 |

8% |

140 |

26% |

121 |

-27% |

|

Nov-21 |

162.2 |

-2% |

222 |

-10% |

128 |

19% |

128 |

-25% |

|

Dec-21 |

137.3 |

-2% |

199 |

-5% |

101 |

10% |

103 |

-22% |

|

Jan-22 |

164.0 |

3% |

235 |

-6% |

124 |

26% |

120 |

-17% |

|

Feb-22 |

173.8 |

3% |

247 |

-4% |

135 |

28% |

117 |

-28% |

|

Mar-22 |

221.6 |

5% |

320 |

-4% |

168 |

29% |

150 |

-20% |

|

Apr-22 |

203.1 |

5% |

297 |

0% |

145 |

18% |

167 |

-9% |

|

May-22 |

204.2 |

6% |

311 |

9% |

132 |

3% |

188 |

0% |

|

Jun-22 |

173.4 |

-3% |

259 |

5% |

114 |

-12% |

167 |

-12% |

|

Jul-22 |

152.2 |

-15% |

224 |

-8% |

106 |

-22% |

132 |

-22% |

|

Aug-22 |

129.3 |

-30% |

187 |

-28% |

95 |

-34% |

100 |

-25% |