Project-starts continue to fall, but non-residential project-starts slow the decline

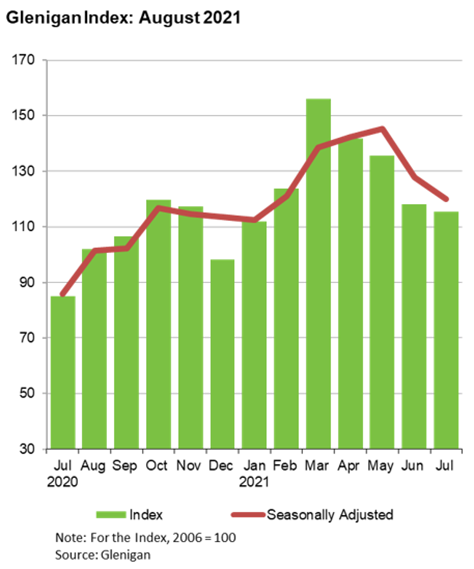

– The value of underlying work (less than £100 million in value) starting on-site fell 16% during the three months to July on a seasonally adjusted basis. While being 36% higher than a year ago, the value declined by a quarter compared with the same period in 2019.

– Residential project-starts increased 36% against the previous year but fell 28% compared with the preceding three months as well as by a third compared with two years ago.

– Non-residential work starting on-site climbed 8% against the preceding three months to stand 45% higher than a year ago. However, the value remained 10% lower than the same period in 2019.

– Infrastructure starts climbed 1% against the previous year but fell 41% compared with the preceding three months and 40% against the same period in 2019.

While the value of project-starts remains substantially higher than the lockdown-affected previous year, the value has continued to decline in recent months. Material supply problems may have contributed to the fall, however a decline was expected following a surge in activity, due to pent-up demand, during the first quarter.

More positively, the speed of decline slowed during July. Main contract awards and detailed planning approval were high compared with previous years, so it is only a matter of time before this has a positive impact on project-starts. Furthermore, the successful vaccination roll-out, as well as the ending of restrictions on daily life, should give investors particularly in non-residential sectors, such as hotel & leisure, the confidence to progress projects to site.

Sector Performance

The value of residential work commencing on-site climbed 36% against the previous year but remained 33% lower than the same period in 2019 and fell 28% compared with the preceding three months (seasonally adjusted). Private housing was one the best-performing sectors against the previous year with the value of project-starts having risen by 54%. However, private housing-starts remained 32% below 2019 levels and slipped-back 29% compared with the preceding three months. Social housing project-starts performed poorly, remaining unchanged on the previous year as well as declining 23% against the preceding three months and 38% compared with the same period in 2019.

Non-residential sectors performed relatively well, having climbed 45% against the previous year as well as 8% compared with the preceding three months on a seasonally adjusted basis. Non-residential project-starts were 10% below 2019 levels, though this was a relatively small decline compared to other areas. Retail was the stand-out sector during the period, with project-starts having increased 169% against the previous year and 94% compared with the same period in 2019. Retail-starts also doubled compared with the preceding three-month period.

Although health project-starts fell 12% against the preceding three months, the sector achieved growth of 7% against the previous year and was the only other sector to experience an increase compared with the same period in 2019 (43%). Hotel & Leisure project-starts have performed poorly in recent months, however the sector experienced growth of 94% against the previous year and 52% compared with the preceding three months to stand only 6% below 2019 levels. Office and industrial starts both experienced strong growth against the previous year but remained 16% and 11% below 2019 levels respectively.

Underlying civil engineering project-starts increased 1% against the previous year but fell 41% against the preceding three months (seasonally adjusted) in addition to 40% compared with the same period in 2019. Infrastructure starts performed particularly poorly and fell 16% against the previous year and 49% compared with the preceding three months to stand 43% down on the same period in 2019. Utilities starts increased 47% against the previous year but declined 18% against the preceding three months and 35% compared with 2019 levels.

Regional Performance

The value of project-starts in all areas of the UK during the three months to July were still below 2019 levels. However, there were some regional bright spots, including Scotland which achieved the strongest growth against the previous year (124%). Despite this, the value remained a fifth below the same period in 2019 and fell 14% compared with the preceding three months (seasonally adjusted). Yorkshire & the Humber also achieved three-digit growth against the previous year (110%). However, project-starts fell 14% compared with the preceding three-month period as well as 10% against the same period in 2019.

Project-starts in the Capital climbed 50% against the previous year but fell 8% against the preceding three months. Like Scotland, project-starts in London also remained a fifth behind 2019 levels. Project-starts in the East of England climbed 58% against the previous year and were the closest to 2019 levels out of all regions (-9%). The region was also the only region to experience growth against the preceding three months (8%). The North East, South East and Wales all experienced declines against the previous year, preceding three months and two years ago.

Glenigan Indices (underlying* projects up to £100 million)

|

|

Glenigan Index |

Residential |

Non-residential |

Civil engineering |

||||

|

|

Index |

% Change |

Index |

% Change |

Index |

% Change |

Index |

% Change |

|

Jul-20 |

85.1 |

-44% |

95 |

-51% |

77 |

-38% |

90 |

-40% |

|

Aug-20 |

102.0 |

-33% |

119 |

-40% |

93 |

-25% |

88 |

-34% |

|

Sep-20 |

106.5 |

-29% |

130 |

-33% |

88 |

-28% |

113 |

-15% |

|

Oct-20 |

119.6 |

-4% |

142 |

-7% |

98 |

-11% |

144 |

42% |

|

Nov-20 |

117.4 |

-4% |

146 |

4% |

91 |

-18% |

145 |

19% |

|

Dec-20 |

98.3 |

0% |

121 |

7% |

81 |

-9% |

104 |

13% |

|

Jan-21 |

112.0 |

-2% |

151 |

16% |

83 |

-20% |

119 |

5% |

|

Feb-21 |

123.9 |

7% |

165 |

21% |

91 |

-11% |

139 |

25% |

|

Mar-21 |

156.1 |

24% |

210 |

43% |

113 |

6% |

177 |

24% |

|

Apr-21 |

141.8 |

46% |

180 |

57% |

106 |

37% |

179 |

40% |

|

May-21 |

135.5 |

80% |

162 |

89% |

109 |

90% |

171 |

39% |

|

Jun-21 |

118.1 |

54% |

128 |

59% |

105 |

58% |

144 |

33% |

|

Jul-21 |

115.5 |

36% |

129 |

36% |

112 |

45% |

90 |

1% |